Equity Trust receives compensation for investments made by their clients in Yieldstreet products, creating a conflict of interest. Equity Trust is not a client or investor in any Yieldstreet products.

Yieldstreet at a glance10

$3.9B+

invested since inception in 2015

450K+

trusted members and counting

9.6%

realized net annualized return

We’ve redefined how you invest in your IRA

Equity Trust and Yieldstreet teamed up to make it possible to invest with your retirement account in minutes.

1

Connect from myEQUITY

Your account is securely linked to Yieldstreet through our new WealthBridge platform.

2

Browse investments

Discover our wide range of curated private market opportunities.

3

Invest in a few clicks

Funding is automatically transferred. No forms or manual transfers required.

Partnership featured in the following publications

The Yieldstreet advantage

Our goal is to make it delightfully easy to add private market alternatives to your IRA.

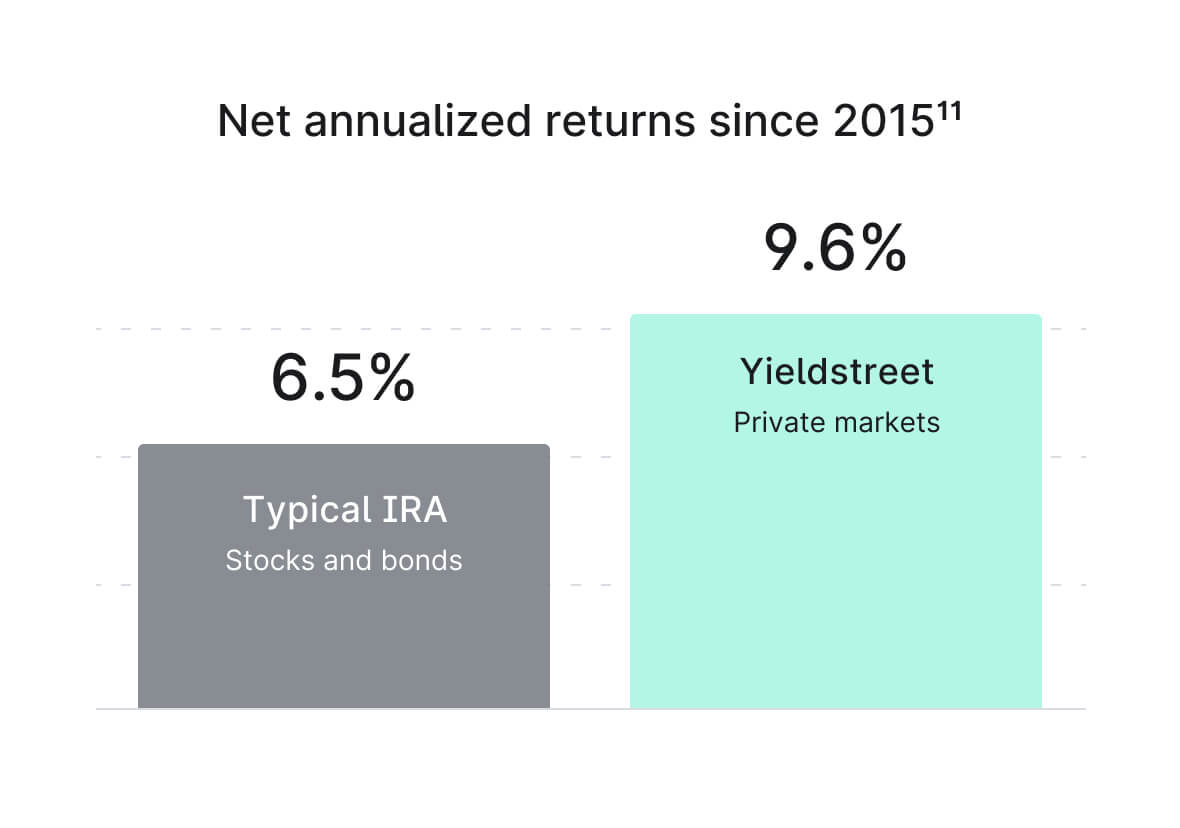

Strong returns through multiple market cycles

Since Yieldstreet’s inception in 2015, our investments have historically outperformed a typical IRA portfolio of stocks and bonds.

Low, transparent fees

Yieldstreet does not charge any account fees. Target and realized returns we publish are inclusive of all fees.

Knowledgeable support when you need it

Yieldstreet and Equity Trust IRA professionals are just a click or call away.

Learn more about Yieldstreet

Yieldstreet and Equity Trust announce strategic partnership to expand IRA access to private markets

Yieldstreet and Equity Trust announce strategic partnership to expand IRA access to private markets

10. Source: Yieldstreet. From July 1, 2015 through February 28, 2023.

The realized net annualized return represents a historical average net realized return, using an internal rate of return (IRR) methodology, with respect to all matured investments, except our Short Term Notes program, weighted by the investment size of each individual investment, made by private investment vehicles managed by YieldStreet Management, LLC, after deduction of management fees and all other expenses charged to investments. Past Performance is not indicative of future results.

Cumulative historical interest and principal returns since inception are based on unaudited internal calculations, are subject to change, and may differ from fund returns and payments that an investor will actually receive.

11. The realized net annualized return represents a historical average net realized return, using an internal rate of return (IRR) methodology, with respect to all matured investments, except our Short Term Notes program, weighted by the investment size of each individual investment, made by private investment vehicles managed by YieldStreet Management, LLC since inception in 2015 through Q3 2022, after deduction of management fees and all other expenses charged to investments. All calculations are based on unaudited internal calculations, are subject to change, and may differ from the fund performance, returns and payments that an investor will actually receive. Numbers presented are rounded to the nearest decimal.

The Traditional Portfolio represents a custom blend calculated by Yieldstreet of the S&P 500 Index (60%) and Bloomberg US Aggregate Bond Index (40%) from Q1 2015 to Q3 2022. Yieldstreet’s historical investment offerings and holdings in a Traditional Portfolio differ materially. Financial indices assume the reinvestment of dividends and do not reflect the impact of fees, taxes and other expenses. Indices are unmanaged, and you cannot make a direct investment in an index. Statistical data of the indices has not been independently verified by Yieldstreet

12. Source: Yieldstreet. From July 1, 2015 through February 28, 2023.

The realized net annualized return represents a historical average net realized return, using an internal rate of return (IRR) methodology, with respect to investments in the asset class, weighted by the investment size of each individual investment, made by private investment vehicles managed by YieldStreet Management, LLC, after deduction of management fees and all other expenses charged to investments. Past Performance is not indicative of future results.

Returns are based on unaudited internal calculations, are subject to change, and may differ from fund returns and payments that an investor will actually receive.

Yieldstreet is not an affiliate of Equity Trust Company (“Equity Trust”). As Equity Trust is a directed custodian, like any investment, it is your responsibility to conduct your own due diligence before investing and before choosing a provider that is right for you. Investing involves risk, including possible loss of principal. Equity Trust makes no recommendation or representations as to any provider or the needs generally of any IRA owner or any IRA. Any information communicated by Equity Trust is for informational purposes only and should not be construed as tax, legal, or investment advice. Clients are in no way obligated to invest with Yieldstreet and are free to select any provider or investment as they deem appropriate. No customer may rely on any statement made by Equity Trust or any of its officers, directors, employees, or agents for any decisions regarding Yieldstreet. Whenever making a decision related to your account, please consult with your tax, financial, or legal professional

Pursuant to a services agreement, Equity Trust will receive a payment, in general terms, of one percent of the amounts that each Equity Trust IRA account holder invests in Yieldstreet offerings. This relationship creates a material conflict of interest given there is a financial benefit for Equity Trust to participate in this partnership with Yieldstreet. While Equity Trust offers no investment advice or investment advisory services to their customers, it does receive a financial benefit when a client invests with Yieldstreet and it has an interest in the success of this partnership with Yieldstreet. Equity Trust may not have made these positive statements about or otherwise be associated with Yieldstreet were it not for the overall partnership and asset-based compensation arrangement.